The Financial History of the U.S. Postal Service

Over the last two decades, historical events, legislative enactments, and operational performance have shaped the U.S. Postal Service’s financial results. Throughout the 1990s, the Postal Service’s profitability fluctuated, and the early 2000s saw more net losses than net incomes. Fiscal year (FY) 2006 was the last year the Postal Service recorded a profit, as First-Class Mail, its most profitable product, declined with the emergence and normalization of email and electronic bill payment options.

In December 2006, Congress passed the Postal Accountability and Enhancement Act (PAEA), which was intended to reshape the financial and operational landscape of the Postal Service. The legislation required the Postal Service to prefund its retiree health obligations through 10 annual payments of more than $5 billion each. The law also limited the Postal Service’s ability to raise prices on certain products.

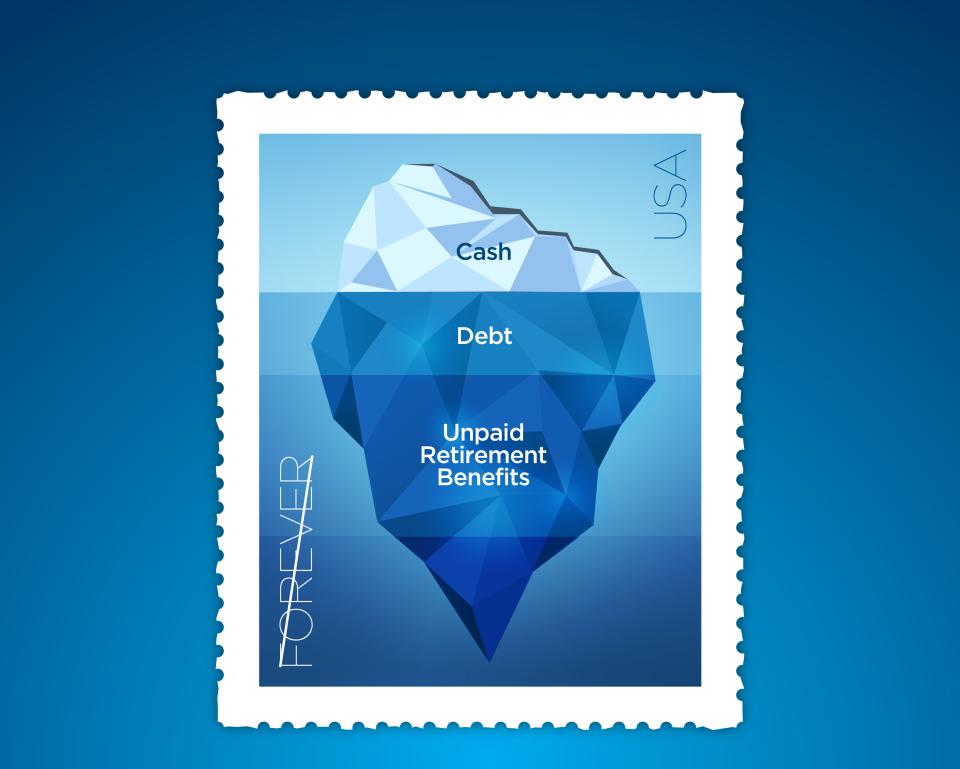

Soon after the passage of PAEA, the Great Recession and the continued diversion to electronic communication suppressed mail growth. As the Postal Service made prefunding payments between FYs 2007 and 2010, it borrowed from the U.S. Treasury to maintain sufficient liquidity, taking debt from $2.1 billion in FY 2006 to $15 billion by the end of FY 2012. To conserve cash for operations, the Postal Service defaulted on its remaining prefunding payments, postponed infrastructure maintenance, and froze capital spending — prioritizing payments to employees and suppliers. Following FY 2012, the Postal Service had modest revenue gains, and although expenses continued to accelerate, cash levels grew steadily through the accumulation of debt and unpaid retirement benefits.

In 2020, the COVID-19 pandemic disrupted the Postal Service’s operations, and the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed by Congress provided $10 billion in funding to the Postal Service for pandemic-related operating expenses. Later that year, the Postal Regulatory Commission (PRC) also authorized additional pricing flexibility for certain Postal Service products. The next year, the Postal Service published its Delivering for America plan, calling for increased investment in capital projects and reform for retirement obligations, among other organizational initiatives. In FY 2022, Congress passed the Postal Service Reform Act, which in part addressed partial retirement obligations reform, eliminating $57 billion in unpaid retiree healthcare liabilities from the Postal Service’s balance sheet.

The Postal Service mitigated 18 years of recorded net losses by maximizing its debt limit, suspending some retiree payments, postponing infrastructure maintenance, and freezing capital spending. In addition, funding provided by the Coronavirus Aid, Relief, and Economic Security Act and postage price increases allowed the Postal Service some flexibility to manage liquidity.